If you are an employer, you are required to deposit your employment taxes on a regular schedule that’s dependent on the usual amount of the deposit. … Read more about What To Do If You Fall Behind in Tax Deposits

Additional Taxes on Small Business Owners

There’s been much discussion about “taxing the rich” and making them “pay their fair share.” What may get lost in the discussion are the special taxes … Read more about Additional Taxes on Small Business Owners

Writing Off the Cost of Business Driving

Gas prices at the pump have nearly doubled in one year, causing severe strain on business budgets. This is especially so for businesses that are based … Read more about Writing Off the Cost of Business Driving

A Tax Portrait of Business Owners

With National Small Business Week recently passed, it’s a good time to look at how business owners appear on their personal tax returns. The IRS’s … Read more about A Tax Portrait of Business Owners

You Pay Company Expenses: Who Takes the Deduction?

It’s common for business owners to pay various expenses from their own pockets. It just may be easy to do. But it can impact who takes the deduction … Read more about You Pay Company Expenses: Who Takes the Deduction?

Employers’ Tax Burden for Having Remote Workers

COVID-19 started a revolution in remote work arrangements. Initially, workers were forced to work from their homes because of government-mandated … Read more about Employers’ Tax Burden for Having Remote Workers

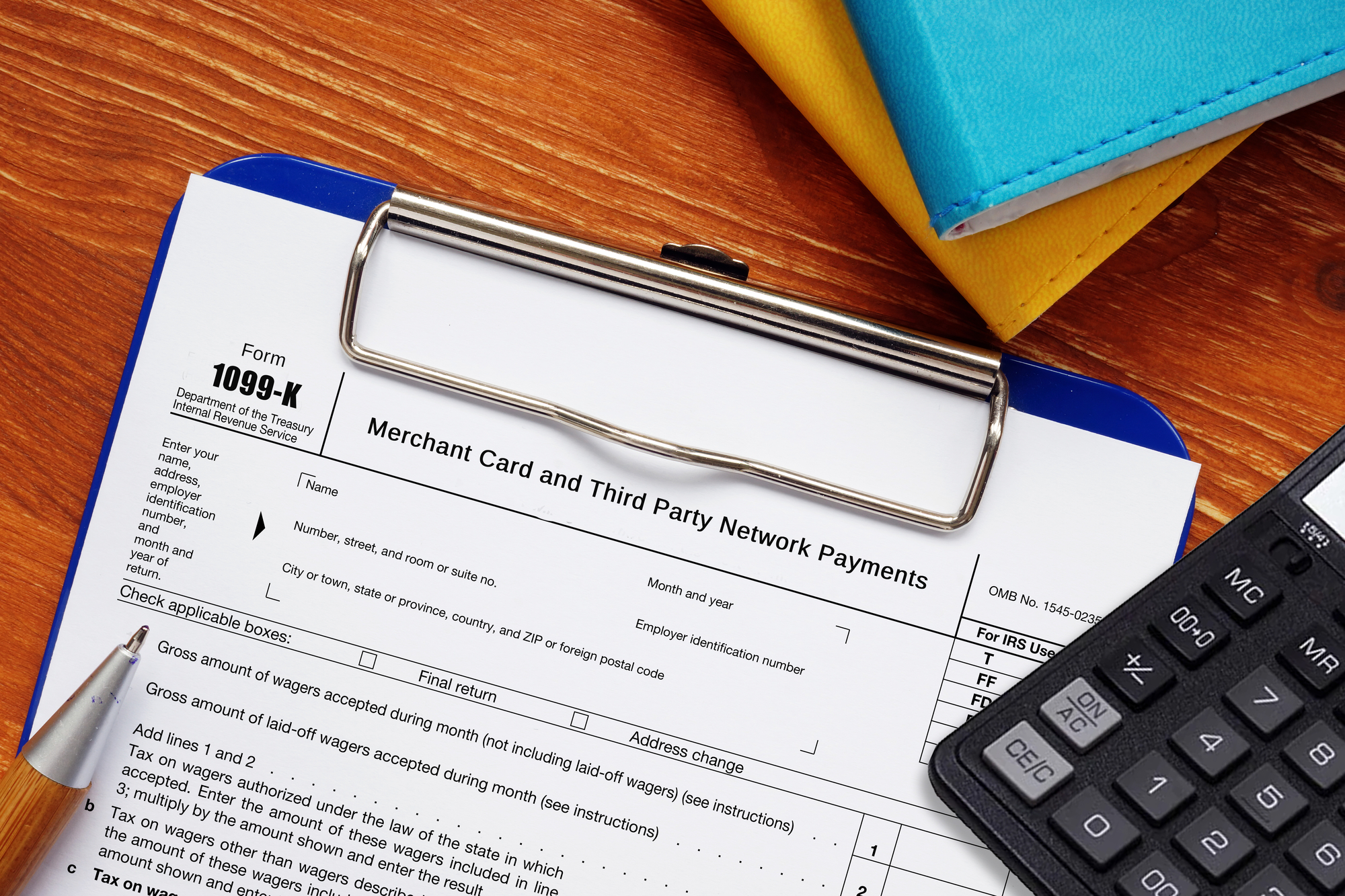

What’s Up with Form 1099-K?

Third-party payments over a threshold amount must be reported annually to the IRS. This is done on Form 1099-K. Who does the reporting, what are the … Read more about What’s Up with Form 1099-K?

Cancellations Can Have Tax Consequences

Things get canceled all the time…meetings and appointments, customer orders, and leases to name a few. Sometimes cancellations are good for your … Read more about Cancellations Can Have Tax Consequences

5 Things to Remember about the Home Office Deduction

The pandemic caused many small business owners to abandon their offices—and the rent for them—in favor of working from home and allowing staff to do … Read more about 5 Things to Remember about the Home Office Deduction

Big Tax Break for Section 1202 Stock: Which Businesses Qualify?

Tax breaks are being pared, but one that remains is the ability of certain corporations to issue stock that owners will eventually be able to sell tax … Read more about Big Tax Break for Section 1202 Stock: Which Businesses Qualify?

Supplement to J.K. Lasser’s Small Business Taxes 2022

The pandemic triggered numerous changes in tax law as reflected in the book. But tax law is not static and new legislation, IRS pronouncements, and … Read more about Supplement to J.K. Lasser’s Small Business Taxes 2022

Supplement to J. K. Lasser’s 1,001 Deductions and Tax Breaks 2022

Tax law is not static and new legislation, IRS pronouncements, and court decisions continue to tweak tax rules. They affect reporting on 2021 returns … Read more about Supplement to J. K. Lasser’s 1,001 Deductions and Tax Breaks 2022

Reporting Payments to Independent Contractors: 5 Things to Know

If you engage independent contractors and pay them in the aggregate $600 or more during the year, you must report payments to them and to the IRS. In … Read more about Reporting Payments to Independent Contractors: 5 Things to Know

Some Tax Issues Never Change

In the past several years, business owners have grown accustomed to adapting to many changes in tax rules. Some new rules have been temporary in … Read more about Some Tax Issues Never Change

The Latest Tax Statistics on Partnerships and LLCs

A partnership is not taxpaying entity, but files an annual tax return, Form 1065, to report income, deductions, and other items. These items pass … Read more about The Latest Tax Statistics on Partnerships and LLCs