The hurricanes got me thinking … do employers have to pay their staff during the period that a company is shut down? Hurricanes aren’t the only … Read more about Your Obligation to Employees during Emergency Shutdowns

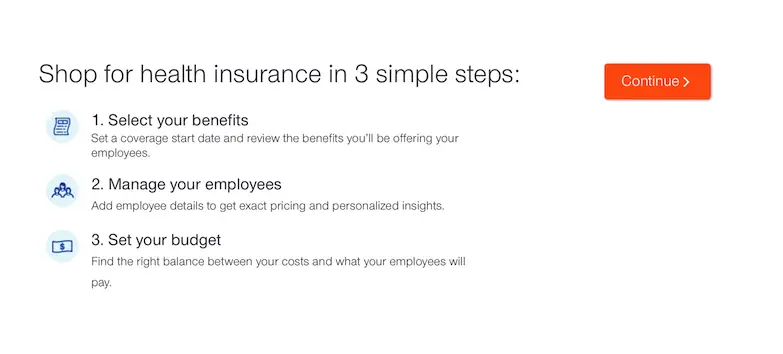

Get Small Business Health Insurance Fast

This is a sponsored post by UnitedHealthcare. All thoughts and opinions are my own. Buying health coverage is increasingly important in this tight … Read more about Get Small Business Health Insurance Fast

Reimbursing Employees for Business Travel

If your employees go out of town on company business, likely the company is picking up the tab. From a tax perspective, there are certain ways to do … Read more about Reimbursing Employees for Business Travel

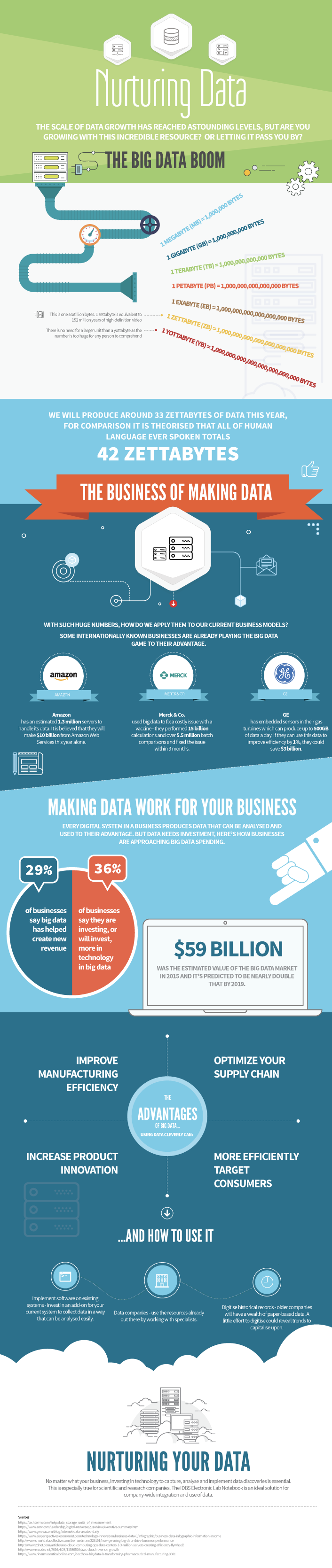

Big Data and Small Business

According to Dictionary.com, big data is consists of “billions or trillions of records that are so vast and complex that they require new and powerful … Read more about Big Data and Small Business

Sharing Good Ideas

When I started Big Ideas for Small Business, Inc. more than 17 years ago, it was for the purpose of publishing information for small business owners. … Read more about Sharing Good Ideas

Handling Plan Loans

Shakespeare said in Hamlet “neither a borrower nor a lender be,” but he didn’t know about 401(k) plans and their ability to offer easy terms for … Read more about Handling Plan Loans

New Way to Shop for Health Care Coverage

This is a sponsored post by UnitedHealthcare. All thoughts and opinions are my own. The status of the Affordable Care Act is up in the air and … Read more about New Way to Shop for Health Care Coverage

Payment Card Security: How Do You Measure Up?

Equifax recently experienced a data breach that impacted an estimated 143 million people. If it can happen to Equifax, it can happen to any business. … Read more about Payment Card Security: How Do You Measure Up?

The Forgotten Estimated Taxes

Estimated taxes aren’t a separate liability but rather a way of paying taxes throughout the year in four installments. The third estimated tax payment … Read more about The Forgotten Estimated Taxes

Cost-Free Discounts and Rewards for Employees

If you can give your employees a benefit that doesn’t cost you anything, wouldn’t you do it? Owners should check on discounts and rewards that can … Read more about Cost-Free Discounts and Rewards for Employees

5 Actions to Take Now for the Holidays

While wreathes, mistletoe, and menorahs may seem a long way off, businesses should be gearing up now for the holiday season. Kiplinger is predicting … Read more about 5 Actions to Take Now for the Holidays

Disaster Brings Loss — Rebuilding Brings Benefits

September is National Preparedness Month, so on the heels of Hurricanes Harvey, Irma and Maria it seems appropriate to review what disasters mean to … Read more about Disaster Brings Loss — Rebuilding Brings Benefits

Terminology to Know

We’re living in an age of information overload, with large amounts of new information continually being created and bombarding us. Alan Toffler said … Read more about Terminology to Know

Legislative Initiatives and their Impact on Small Businesses

There is considerable attention on major bills in Washington that surely will impact small businesses, such as health care and tax reform. But there … Read more about Legislative Initiatives and their Impact on Small Businesses

Privacy in the Workplace

How much can or should an employer intrude on employees’ personal activities? With technology, such as GPS, employer-provided cell phones, and company … Read more about Privacy in the Workplace